Signet Jewelers posted earnings in line with estimates but guidance from the diamond seller helped the shares sparkle.

For the fourth quarter, Signet (ticker: SIG) posted adjusted earnings of $5.01 a share, in line with the consensus call. Revenue of $2.81 billion was a smidge higher than both management’s expectation’s and analysts’ estimates of $2.77 billion.

The jeweler, which owns the Zales and Kay brands, expects to generate revenue in the range of $1.78 billion to $1.82 billion in the first quarter, higher than the $1.74 billion estimated by analysts. For fiscal 2023, the company expects $8.03 billion to $8.25 billion in sales, well ahead of the $7.89 billion that Wall Street expects.

Signet also said in its news release that it was increasing the quarterly cash dividend in the first quarter, ending April, by 11% to 20 cents a share from 18 cents. Planned expenditures have been increased up to $250 million in fiscal 2023.

The company delivered revenue of $7.83 billion for fiscal 2022, which ended in January. Analysts tracked by FactSet expected $7.79 billion in revenue and management had predicted $7.78 billion.

The stock was up 6.1% to $82.44 on Thursday.

Signet has had a great year, repeatedly lifting its guidance in 2021, improving its balance sheet, and beefing up its digital sales capabilities. While the at-home nature of the pandemic didn’t lend itself to jewelry sales at first, consumers were quick to return to the category last year, bolstered by stimulus checks. Signet shares are up over 30% in the past year.

Yet like so many retail stocks, Signet has also seen its shares get crushed more recently. The stock is down over 10% year-to-date on worries that pinched consumers are grappling with soaring prices for everything from food to gasoline and housing. The fear is that rather than going shopping, they will want to spend what little spare money they have on things like sporting events and vacations, which had been postponed during the pandemic.

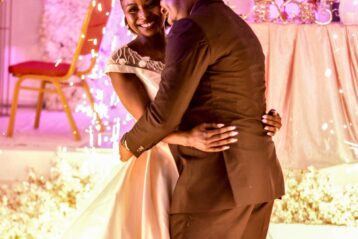

Yet at least on that note, Signet has an edge: many weddings had been put on hold during the pandemic, and an increase in matrimonials could mean the sale of more engagement rings, which is good news for the world’s largest diamond retailer.

Signet Chief Financial Officer Joan Hilson spoke with Barron’s following the report, and says that she’s especially proud of the company’s ability to grow market share “in every channel in every banner,” as its brands across the spectrum resonate with consumers.

Strong vendor relationships and vertical integration have helped the company avoid much of the pain around supply-chain issues that have plagued other retailers, Hilson notes—a key consideration given that Signet expects we’ll see more weddings this year than in the past forty years, as the threat of the pandemic recedes. Not only is that good news for its engagement-ring sales, but weddings as a whole are a positive cycle for Signet, as couples buy wedding bands, jewelry for the wedding party, and often inspire guests to get engaged themselves.

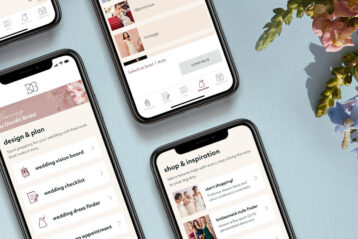

Moreover, as more people start their buying process online, Signet’s digital capabilities—which the company has invested in heavily in recent years—has resonated with customers. She notes that nearly three-quarters of the company’s high-value customers begin shopping online, a trend that looks likely to stick even when the pandemic is behind us. Given that the company has closed roughly 20% of its stores over the past four years but continues to see sales climb speaks to Signet’s success in capturing online business.

Hilson says that Signet is in the position to sustain double-digit operating margins, because of the various strategies that it’s put in place in recent years. Not only has the company improved omnichannel capabilities, but it’s also streamlined inventory management and visibility so that “at the touch of an iPad our consultants can get the inventory customers want.” Data analytics are improving the company’s staffing at its leaner fleet, as well as contributed to overall balance-sheet control. “We’re building muscle around good working-capital management,” Hilson says.

Write to Karishma Vanjani at karishma.vanjani@dowjones.com and Teresa Rivas at teresa.rivas@barrons.com