Natural Rough Diamonds Prices Set New Record According to the Zimnisky Global Rough Diamond Price Index

NEW YORK (PRWEB) FEBRUARY 15, 2022

According to industry analyst Paul Zimnisky, record global diamond jewelry demand combined with decade-low diamond production has driven natural diamond prices to a new all-time high in early-February 2022.

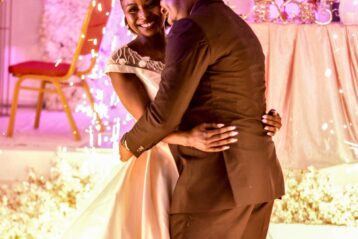

“Diamonds have fared exceptionally well in recent quarters—all of the moons have aligned. Significant economic stimulus in key markets; a slow return to experience-spending; pent-up engagement and wedding demand; plus, diamonds have historically done well in times of distress and this proved true once again over the last two years. In addition, the industry has begun to invest in ‘category marketing’ again following a decade-long lapse. So, I think all of this has contributed to the demand side of the equation,” said Zimnisky.

“This, combined with pandemic-related disruptions to supply, compounding an already existing trend of declining natural diamond output, has pushed prices to new levels,” Zimnisky added.

According to Zimnisky Global Rough Diamond Price Index, a consolidated price index for natural diamonds, prices have now overtaken the previous all-time high set in 2011. A brand-new surge in demand for diamonds from Chinese consumers led to record prices early last decade. This eventually served as a catalyst for more supply, resulting in an oversupplied market for much of the 2010’s. This dynamic led to “apathetic price action” for much of the last decade, according to Zimnisky.

However, “today, the fundamental picture for diamonds is the best it has been in some time as a healthy level of supply, expected into the medium-term, will allow incremental demand to continue to push prices higher,” said Zimnisky.

In 2021, natural rough diamond prices were up over 30% according to the Index. In 2022, through the second week of February, prices are up about 5%.

A 52-week chart of the Zimnisky Global Rough Diamond Price Index, which is updated weekly, can be found here or at RoughDiamondIndex.com. A longer-term, 2008-2022, annotated chart of the Index can be viewed here. An even longer-term chart can be found here.

—

Paul Zimnisky, CFA is a leading independent diamond industry analyst and consultant based in the New York metro area. His research and analysis on the diamond industry is used globally by financial institutions, management consulting firms, private and public corporations, governments, intergovernmental organizations and universities. More information can be found here. He can be reached at [email protected] and followed on Twitter @paulzimnisky.

For detailed analysis of the natural and lab-grown diamond industry, please inquire for information on consultation rates and custom research capabilities. For subscription information or to request a sample of Paul Zimnisky’s State of the Diamond Market, a leading monthly diamond industry report which includes data, trends and forecasts, please contact: [email protected].

The Paul Zimnisky Diamond Analytics Podcast can be streamed for free here or on Apple Podcasts or Spotify. Recent guests include industry journalist and author Rob Bates, ALROSA Deputy CEO Evgeny Agureev and ALTR Created Diamonds president Amish Shah.

Disclaimer: The views expressed above are strictly that of Paul Zimnisky, and are based solely on observations and opinions. Paul Zimnisky has made every effort to ensure the accuracy of information provided, however, accuracy cannot be guaranteed. The information is strictly for informational purposes and should not be considered investment advice. Consult your investment professional before making any investment decisions. Paul Zimnisky does not accept culpability for losses and/ or damages arising from the use of the above content. Third party use of this content is only permitted with the permission of Paul Zimnisky.