NEW YORK, Nov. 4, 2021 /PRNewswire/ — Today, Brides and Investopedia released findings from Weddings & Money 2021: A Brides & Investopedia Study. The first collaboration between the two Dotdash brands, the study reveals how COVID-19 impacted–and continues to impact–weddings and wedding planning, financing, and how couples think about finances within the context of their relationship.

Brides and Investopedia surveyed 1,000 American adults (18+) across a wide range of demographics including age, race, income, geographic location, and sexual orientation. Respondents are currently planning their weddings, all taking place over the next two years. Results and analysis of the survey can be found in separate stories on Brides and Investopedia, detailing exactly how COVID-19 impacted the affected couples from a wedding logistics and financial standpoint. Some of the most significant survey results include:

The Weddings:

In the 19 months of full or partial restrictions from COVID-19, the wedding industry has been in a tailspin, first shutting down completely, and then bouncing back to a wedding boom, as couples rescheduled or began planning weddings that were on hold. As the industry continues to navigate the pandemic, most couples are pivoting, altering the size, location, type of venue, budget, and incorporating their own COVID-19 restrictions.

“After nearly two years of COVID-19 restrictions keeping so many loved ones from each other, it’s such a bright light that, while we’re still mid-pandemic, couples are determined to marry and celebrate however they can,” said Leah Wyar, Brides’ Senior Vice President and General Manager. “The wedding industry seems newly reenergized, and I’m sure that some of the pandemic-necessary changes, like more intimate gatherings and new, non-traditional elements, are here to stay.”

- Couples are going ahead with weddings even as 41% have postponed: The ongoing pandemic hasn’t slowed couples’ planning, even with the possibility of having to change their original plans. Forty-one percent of couples have had to change their wedding date (several have postponed multiple times), and 38% of those who postponed lost money as a result.

- 91% of couples are implementing COVID-19 restrictions: Couples are going ahead with the wedding, but they also want to keep the entire party safe: 91% of respondents are building some sort of COVID-19 logistics into their celebrations. Approximately a third of respondents will require vaccines (33%) or COVID tests (35%), while the most common measures include implementing a mask requirement (44%), social distancing (40%), and utilizing outdoor venues (43%).

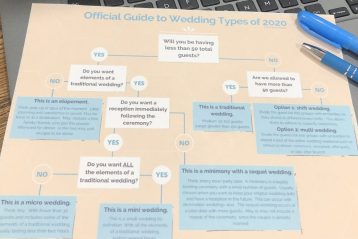

- Weddings have become smaller, more adaptable, and less traditional: Smaller weddings are here to stay, with those planning weddings looking for smaller and more intimate venues, or outdoor spaces. At the same time, couples are making celebrations more non-traditional with flexible elements and timeline. Thirty-five percent of respondents plan to invite fewer people because of the pandemic, while only about half (49%) plan to have a wedding party. The weddings being planned now often feel more in line with the couples’ personalities, rather than wedding tradition–only 37% plan to incorporate a religious ceremony, 35% will have a loved one officiate, and 28% will wear something other than the classic white dress or suit.

The Money:

Cash savings remains the most common way engaged couples plan to fund their wedding, but it’s not the only method. The Weddings & Money 2021 study found many couples are now pooling funds from a variety of sources, including traditional sources like mom and dad—to the non-traditional, like stimulus checks.

“Couples planning weddings have become much more creative and resourceful when it comes to footing the bill,” said Caleb Silver, Editor-in-Chief of Investopedia. “The use of profits from selling investments and more reliance on low interest credit cards demonstrate a more sophisticated approach to paying for or financing a wedding than we have seen in years past.”

- The average U.S. wedding budget is $20,000, with about $7,250 paid for with savings. The remaining budget tends to be financed, borrowed, or funded by financial products. One in five U.S. couples will use loans or investments to help pay for their wedding, while 41% plan to use credit cards, charging $8,000 of wedding costs on average.

- 1 in 5 U.S. couples plan to sell investments to help pay for their wedding, while another 1 in 5 say they’ll use their stimulus checks. Couples in the Western U.S. were most likely to say they’d sell investments, use credit cards, or take out a loan. Midwestern couples were most likely to say they’d use stimulus checks, and those in the Northeast were most likely to use savings.

- 48% of those actively planning their weddings already share joint financial accounts. Checking, credit card, and investment accounts are the most common joint accounts among U.S. couples who are planning their weddings, though despite combining finances prior to the wedding, only a third (33%) plan on signing a prenup.

- Nearly 9 out of 10 respondents said they’ve put off at least one major financial priority in order to pay for their wedding. Financial goals delayed in lieu of paying for a wedding included saving for a home (36%), starting or growing a family (24%), and saving for retirement (22%).

For full analysis of the Weddings & Money 2021 study, visit Brides and Investopedia.

About Brides

Brides inspires and guides more than five million monthly users (Comscore, September 2021) as they make decisions from pre-engagement through the honeymoon. Brides is committed to bringing readers an inclusive look at the world of weddings, with every type of couple, every type of wedding and every type of celebration. Brides is part of the Dotdash publishing family.

About Investopedia

Investopedia helps its nearly 16 million monthly U.S. users (Comscore, September 2021) learn how to understand complex financial concepts, improve their investing skills, and learn how to manage their money. Whether in a classroom, a boardroom or a living room, Investopedia editors and its network of financial advisors and experts have answered questions and earned readers’ trust since 1999. Investopedia is part of the Dotdash family of brands.

About Dotdash

Dotdash’s vibrant brands help over 100 million users each month find answers, solve problems, and get inspired. Dotdash is among the largest and fastest growing publishers online, and has won over 80 awards in the last year alone. Dotdash brands include Verywell, Investopedia, The Spruce, Byrdie, Brides and Simply Recipes, among others. Dotdash is an operating business of IAC (NASDAQ: IAC).

Dotdash Media Contacts:

Brides

Rachael Kelley

Director, Communications, Dotdash Beauty & Style

[email protected]

Investopedia

Alexandra Kerr

Director, Earned Media, Dotdash Finance

[email protected]

SOURCE: Dotdash